Strengthen Your GRESB Real Estate Assessments with ClimateFirst

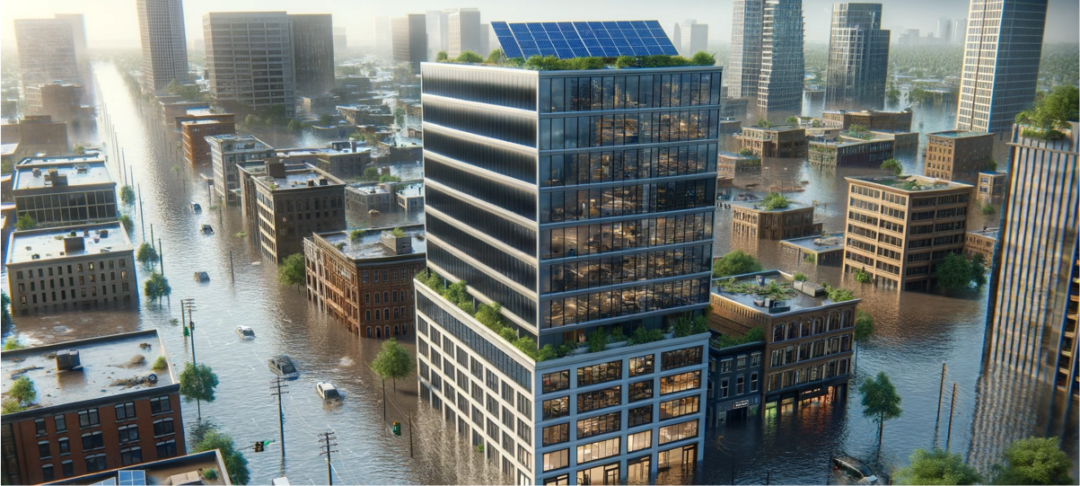

The 2025 GRESB Real Estate Assessment now includes climate risk and resiliency indicators. ClimateFirst can seamlessly address these indicators to maximize scoring.

The 2025 GRESB Real Estate Assessment now includes climate risk and resiliency indicators. ClimateFirst can seamlessly address these indicators to maximize scoring.

An excerpt from a panel focused on adaptation and resilience at MaRS Climate Impact conference (2024) featuring Mike Williams in discussion with Aon’s Natalia Moudrak, Risk Nexus (Canada)’s Tania Caceres and Tailwind’s Katie MacDonald.

Insights from the recent Greenbuild conference highlight how sustainability leaders are aligning on climate resiliency as a key driver for both operational performance and financial outcomes.

USGBC has announced a technology partnership with ClimateFirst. Integrated into the USGBC’s Arc platform, members can now use ClimateFirst to screen for physical climate risks across entire portfolios.

Leaders from across the commercial real estate sector, including the USGBC and Triovest, discuss the importance of climate resiliency.

How to harness the power of insurtech and proptech to safeguard real estate portfolios.

Guidance and case studies for schools preparing for the effects of climate change.

School leaders and climate experts are implementing climate resilience measures to safeguard students and learning.

Explore insights from Tailwind and ClimateFirst on the growing $2 trillion climate adaptation market to protect commercial real estate investments from climate change.

Experts from Intact Centre on Climate Adaptation, BREEAM, ClimateCheck, and ClimateFirst share the latest on managing climate risk for buildings.