ClimateFirst Partners

Climate Risk Management. Simplified.

A changing climate impacts every building differently. Whether for regulatory reporting, due diligence or capital planning, credible climate data and building science insights will enhance your property’s resilience, value, and operational stability.

Three core resilience questions answered by ClimateFirst:

What are the climate risks at this location?

A Climate Risk Exposure Screen identifies and rates a property’s exposure to climate hazards.

What are the financial impacts of these hazards?

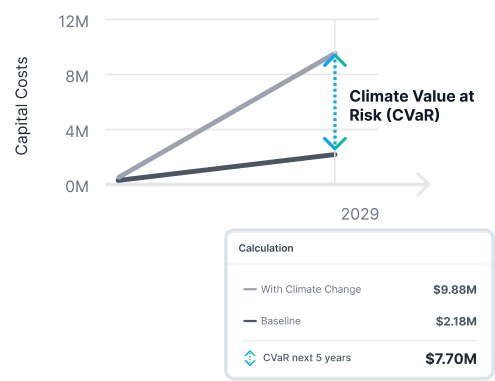

A Climate Value at Risk (CVaR) Assessment estimates the cost of these hazards on building systems.

What should be done to address these risks?

A Resiliency Plan confirms what to do to reduce risks and protect the value and performance of all assets.

Climate Risk Management.

Simplified.

A changing climate impacts every building differently. Whether for regulatory reporting, due diligence or capital planning, credible climate data and building science insights will enhance your property’s resilience, value, and operational stability.

Who is using ClimateFirst

“We chose ClimateFirst for our portfolio’s physical climate risk assessments for a few reasons, but it was their Climate Value at Risk (CVaR) assessments, in particular, that set them apart. By providing specific costs linked to climate risks and recommendations for mitigation – including low and no-cost opportunities – the CVaR assessments help us make better, climate-informed capital planning and investment decisions.”

Nada Sutic

Vice President, Sustainability, Innovation & National Programs

“We chose ClimateFirst for our portfolio’s physical climate risk assessments for a few reasons, but it was their Climate Value at Risk (CVaR) assessments, in particular, that set them apart. By providing specific costs linked to climate risks and recommendations for mitigation – including low and no-cost opportunities – the CVaR assessments help us make better, climate-informed capital planning and investment decisions.”

Nada Sutic

Vice President, Sustainability, Innovation & National Programs

“We chose ClimateFirst for our portfolio’s physical climate risk assessments for a few reasons, but it was their Climate Value at Risk (CVaR) assessments, in particular, that set them apart. By providing specific costs linked to climate risks and recommendations for mitigation – including low and no-cost opportunities – the CVaR assessments help us make better, climate-informed capital planning and investment decisions.”

Nada Sutic

Vice President, Sustainability, Innovation & National Programs

Credible Climate Value at Risk (CVaR) starts from the bottom up.

A building’s resilience relies on the performance of its critical building systems. ClimateFirst Climate Value at Risk (CVaR) Assessments model each system against a property’s specific climate risks to determine its overall CVaR to inform capital and adaptation planning.